Back

25 May 2022

Breaking: FOMC Minutes sink the US dollar a touch despite inflation risk skewed to the upside

Developing story

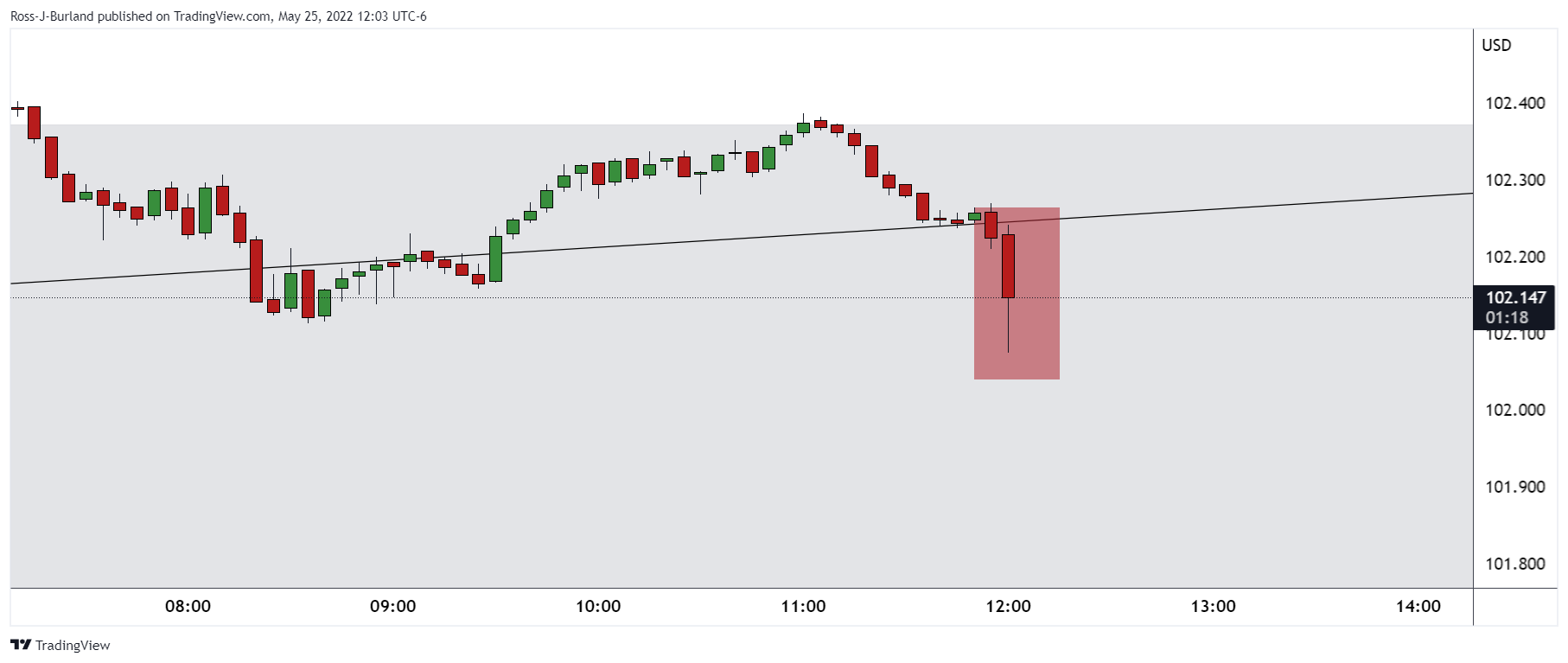

The Federal Open Market Committee minutes have been released which are so far sending the US dollar DXY index a touch softer.

At the May 3-4 meeting, the Fed hiked rates the expected 50 bp to 1.0% and laid out plans for aggressive Quantitative Tightening to begin in June.

FOMC Minutes

- 25-May-2022 12:00:05 - ALL PARTICIPANTS AT FEDERAL RESERVE'S MAY POLICY MEETING AGREED HALF-PERCENTAGE-POINT INTEREST RATE HIKE WAS APPROPRIATE; 'MOST' JUDGED SUCH HIKES APPROPRIATE AT NEXT COUPLE OF MEETINGS, MINUTES FROM MAY 3-4 MEETING SHOW

- 25-May-2022 12:00:05 - ALL FED PARTICIPANTS AGREED U.S. ECONOMY WAS 'VERY STRONG,' LABOR MARKET WAS 'EXTREMELY TIGHT' AND INFLATION WAS 'VERY HIGH,' MINUTES SHOW

- 25-May-2022 12:00:05 - PARTICIPANTS AGREED FED SHOULD 'EXPEDITIOUSLY' MOVE MONETARY POLICY TOWARD A MORE NEUTRAL STANCE, AND THAT 'RESTRICTIVE' STANCE ON POLICY MAY WELL BECOME APPROPRIATE, MINUTES SHOW

- 25-May-2022 12:00:05 - FED PARTICIPANTS SAW UKRAINE CONFLICT, CHINA COVID LOCKDOWNS POSING 'HEIGHTENED RISKS,' WITH PARTICULAR CHALLENGES TO RESTORING PRICE STABILITY WHILE MAINTAINING STRONG JOB MARKET, MINUTES SHOW

- 25-May-2022 12:00:05 - MANY PARTICIPANTS JUDGED FASTER REMOVAL OF POLICY ACCOMMODATION WOULD LEAVE THE FED 'WELL-POSITIONED' TO ASSESS LATER THIS YEAR WHAT FURTHER ADJUSTMENTS WERE NEEDED, MINUTES SHOW

- 25-May-2022 12:00:05 - FED PARTICIPANTS EMPHASIZED THAT THEY WERE 'HIGHLY ATTENTIVE' TO INFLATION RISKS AND AGREED THOSE RISKS WERE SKEWED TO THE UPSIDE, MINUTES SHOW

- 25-May-2022 12:00:05 - ALL PARTICIPANTS SUPPORTED PLANS TO REDUCE SIZE OF FED'S BALANCE SHEET; 'A NUMBER' SAID AFTER RUNOFF WAS WELL UNDER WAY, IT WOULD BE APPROPRIATE TO CONSIDER SALES OF MORTGAGE-BACKED SECURITIES, MINUTES SHOW

- 25-May-2022 12:00:05 - PARTICIPANTS SAID Q1 2022 GDP DECLINE CONTAINED 'LITTLE SIGNAL ABOUT SUBSEQUENT GROWTH,' AND THEY EXPECTED REAL GDP WOULD GROW 'SOLIDLY' IN Q2 AND BE NEAR OR ABOVE TREND FOR THE WHOLE YEAR

Meanwhile, analysts at Brown Brothers Harriman said, ''our base case remains for another 50 bp hike in September that takes the Fed Funds ceiling up to 2.5%, which many consider close to neutral. However, it’s worth noting that odds of a 50 bp move in September have fallen to less than 50% now from fully priced in at the start of May.''

DXY reaction so far..

More to come..