US Dollar Index trims losses post-data, near 92.50

- DXY drops and rebounds from the 92.40/45 band.

- US Durable Goods Orders surprised to the downside.

- CB’s Consumer Confidence came in above estimates.

The US Dollar Index (DXY) has so far met dip-buyers in the vicinity of 92.40 on Tuesday.

US Dollar Index depressed well below 93.00

The index extends the negative streak for the second session in a row amidst disappointing results from the US docket and the lack of traction in US yields.

In fact, June’s Durable Goods Orders expanded 0.8% inter-month and 0.3% when comes to core orders (stripping the Transport sector). Data from the housing sector saw house prices tracked by the FHFA’s House Price Index rising 1.7% MoM in May, and 17.0% on a year to May when measured by the S&P/Case-Shiller Index.

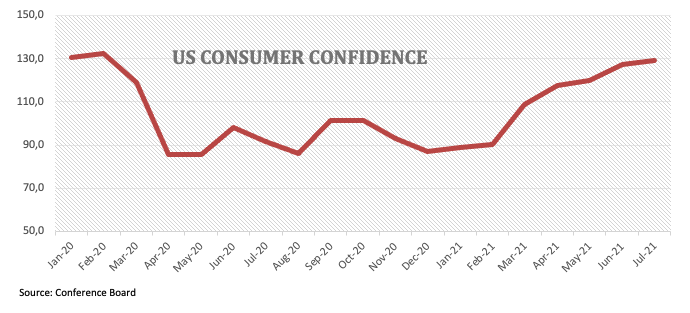

Still in the US data space, and on the brighter side, the always-relevant Consumer Confidence by the Conference Board rose to 129.1 for the month of July (vs.123.9 exp.).

The dollar is now seen to enter a consolidative phase ahead of the key FOMC event on Wednesday, where the QE tapering, inflation and potential move on rates will surely take centre stage.

US Dollar Index relevant levels

Now, the index is losing 0.10% at 92.53 and faces the next support at 92.45 (weekly low Jul.27)) followed by 92.00 (monthly low Jul.6) and then 91.51 (weekly low Jun.23). On the flip side, a break above 93.19 (monthly high Jul.21) would open the door to 93.43 (2021 high Mar.21) and finally 94.00 (round level).