AUD/USD Price Analysis: 61.8% Fibo wasn't to be, bears up the ante

- AUD/USD bears taking charge on the break of 4-hour support.

- Bears can target a daily downside extension to the prior daily support structure.

As per the prior analysis, AUD/USD eyes a 61.8% Fibo retracement and then lower, the bias is with the downside, especially now that the bears have upped the ante and have broken 4-hour support.

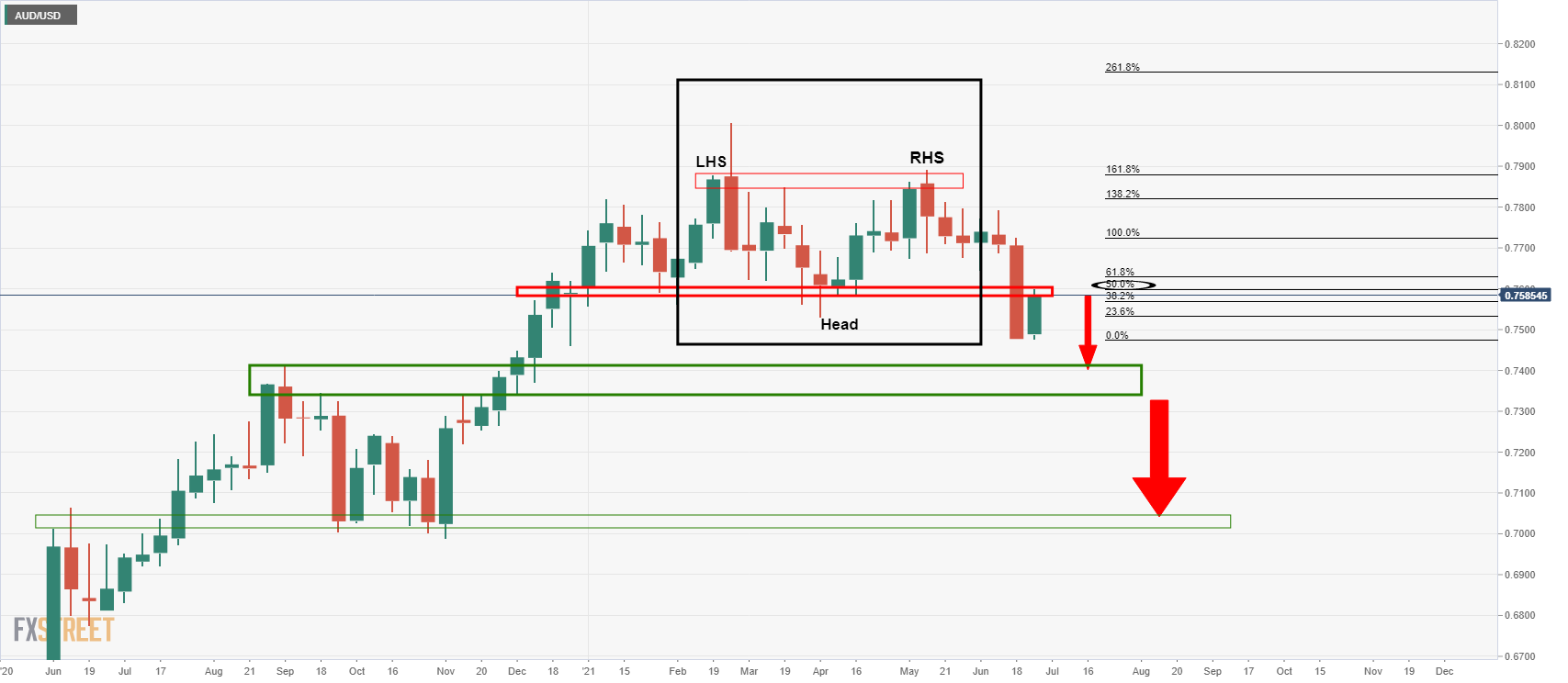

Prior analysis, daily chart

The bulls failed to move all the way up to test the 61.8% Fibo confluence with the early June lows.

Instead, the weekly bearish chart patterns have dominated the price actions, formations that were illustrated in the prior analysis as follows:

''However, scanning out the weekly chart, the first bearish scenario comes with the failed reverse head and shoulders:

Also, we have a double top as a result.''

''A downside continuation would be expected in the sessions ahead with prior structure at 0.7365/0.7410 as a target area.''

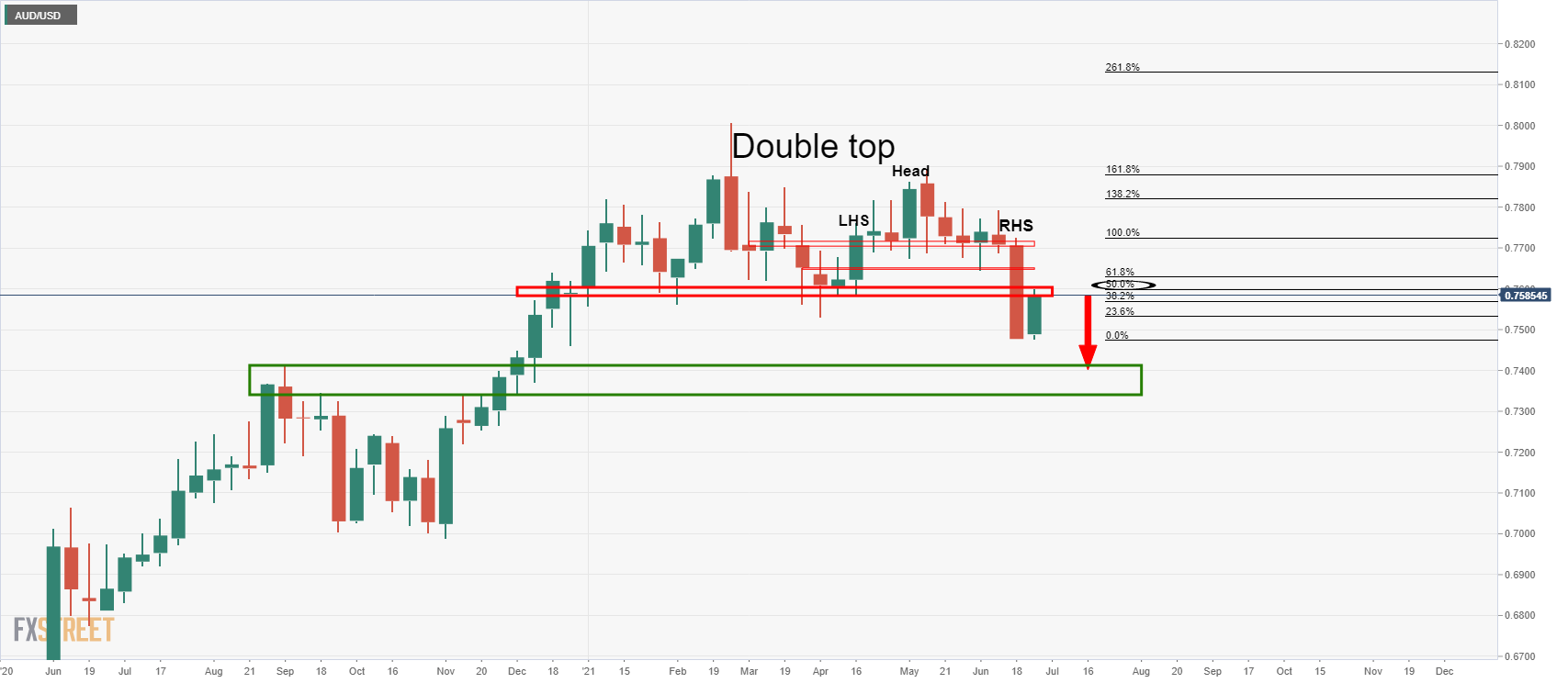

Live market analysis, daily and 4-hour charts

The price has been pressured by the 10-day EMA and would be now expected to continue its southerly trajectory in the form of a fresh bearish daily impulse.

4-hour chart

From a 4-hour perspective, the bears have already broken the prior support structure, 0.7565.

On the retest of the prior lows, 0.7576, now acting as resistance, combined with the crossing of the 10 and 21 EMAs, there are high probabilities of a downside extension at this juncture towards the daily ''0.7365/0.7410 target area.''