GBP/USD: Bulls challenge 100-HMA amid firmer USD, NFP eyed

- GBP/USD eyes 1.36 as the US dollar remains firmer on the session.

- Cracks key averages on the hourly chart, RSI stays bullish.

- Fresh Brexit also remains a cause for concern ahead of NFP.

GBP/USD holds at higher levels, as the bulls look to regain the 1.3600 level despite broad-based US dollar strength and negative Brexit headlines.

The cable stands resilient to the persistent upbeat mood around the US dollar, as the weakness in the EUR/GBP cross lends support to the pound. This comes on the back of a 0.35% drop in EUR/USD amid firming US Treasury yields.

Further, the GBP bulls also remain unperturbed by fresh Brexit concerns, especially on the news that the Scottish fishermen halted their exports to the European Union (EU) over days-long delays due to post-Brexit bureaucracy.

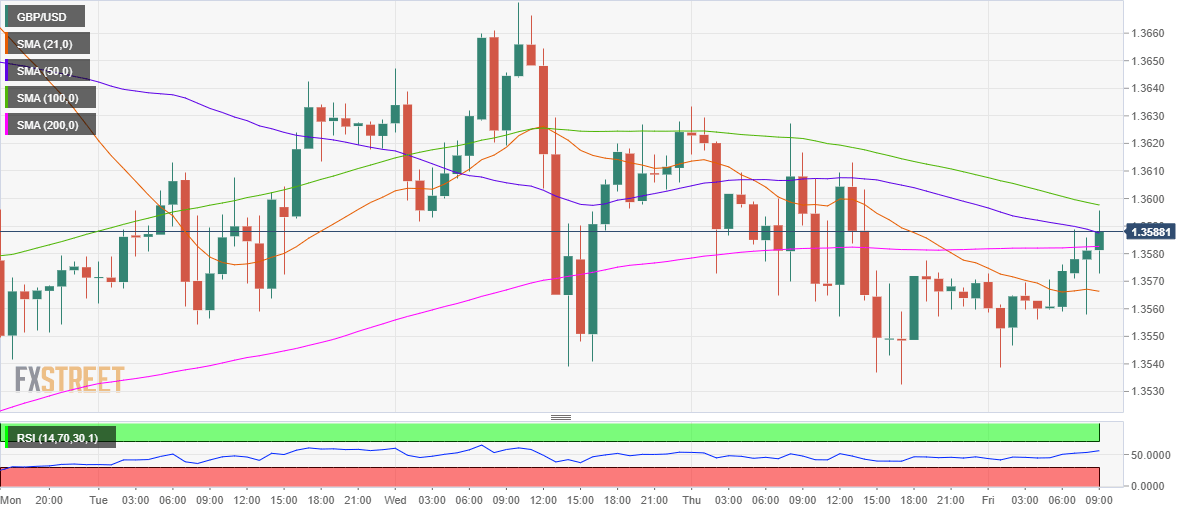

The upside in the cable could be also chart-driven, as the price cuts above the key moving averages on the hourly chart. The bulls are extending control, having found acceptance above the horizontal 200-hourly moving average (HMA) at 1.3582.

Also, the buyers have recaptured the bearish 50-HMA at 1.3587, with the 100-HMA barrier at 1.3597 now capping the further upside. The hourly Relative Strength Index (RSI) points north within the bullish region, suggesting more room to the upside.

On the flip side, relevant support is seen at the 21-HMA of 1.3566. Traders now await the US payrolls data and UK PM Boris Johnson’s briefing on the virus for fresh cues.

GBP/USD: Hourly chart

GBP/USD: Additional levels