EUR/USD grinding against the London breakout and 10-hour ma

- US dollar bounces back with a vengeance, capping EUR bulls in their stride.

- EUR/USD could be on the verge of a downside extension according to hourly chart technical analysis.

EUR/USD is currently trading at 1.2270 having travelled on the day between a low of 1.2245 and 1.2344, suffering from the wounds conflicted in the London breakout.

The US dollar on Thursday bounced to its highest levels in a week as European traders came online and rallied from levels not seen since March 2018.

The US dollar is a compelling topic of discussion amongst analysts that offers an argument from both sides of the bet in the market.

On the one hand, and in the view of Joseph Trevisani, senior analyst at FXStreet, "it’s debatable on how long it is going to take for the vaccines to work and hopefully end the pandemic but once that happens you are going to get a much stronger US recovery and that will lead to a stronger dollar."

On the other hand, considering the Democratic White House expected stimulus measures, the bearish sentiment towards the dollar is also underpinned by market expectations that the Fed will maintain an ultra-accommodative monetary policy for an extended period of time.

Consequently, the demand for risky assets outside the US would be at the expense of the dollar.

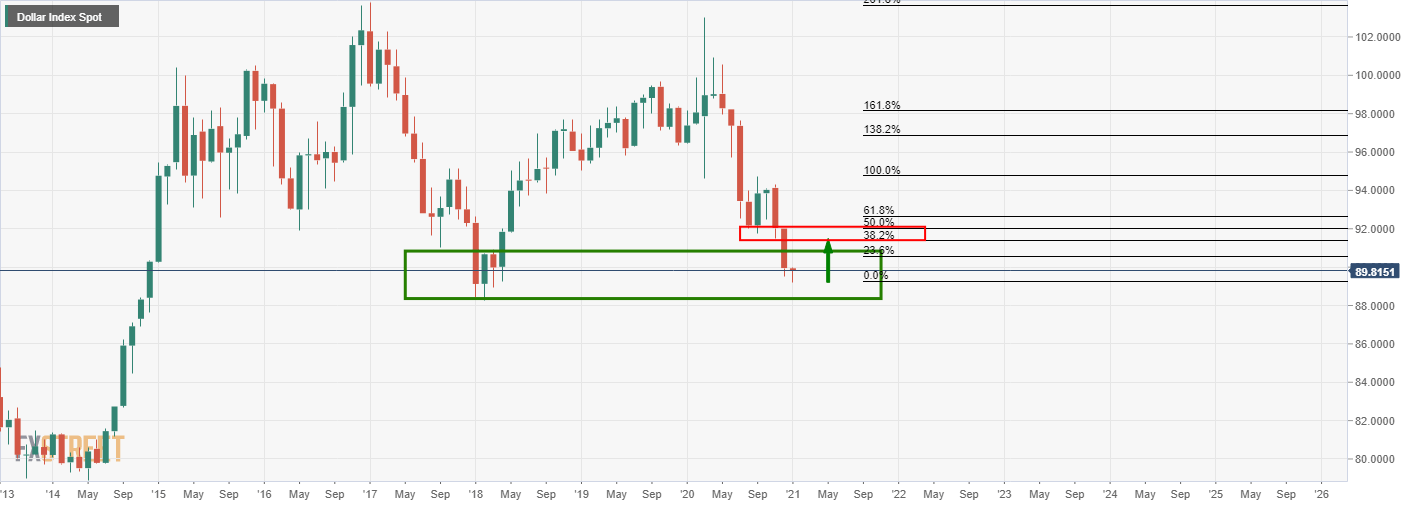

DXY monthly chart

For the meanwhile, however, bond prices are falling and higher yields are helping to fuel profit-taking in an overextended bearish positioning in the bruised greenback, capping the single currency at weekly resistance.

EUR/USD technical analysis

-637456411615423483.png)

Hourly chart

-637456414630588516.png)

A break of the current support will increase the likelihood of a downside continuation from the double top highs in a fresh bearish impulse.

The confluence of the 38.2% and market structure is compelling where we have already seen multiple failures.

MACD is also well below zero and the price is well below the 21 moving average confirming the bearish environment.