EUR/USD weaker, approaches 1.1800 post-IFO

- EUR/USD loses the grip further and trades closer to 1.1800.

- German IFO Business Climate debilitates to 92.7 in October.

- US New Home Sales, Chicago Fed index next in the calendar.

EUR/USD resumes the downside and recedes to the vicinity of the 1.1800 support at the beginning of the week.

EUR/USD softer post-IFO, closer to 1.1800

EUR/USD comes under downside pressure on Monday and trades closer to the 1.1800 mark as market participants remain biased towards the safe havens.

In fact, shrinking prospects of US stimulus at least before the November elections coupled with rising pandemic concerns over the global economic recovery continue to lend support to the demand for the safe haven universe, leaving the pair’s topside somewhat limited.

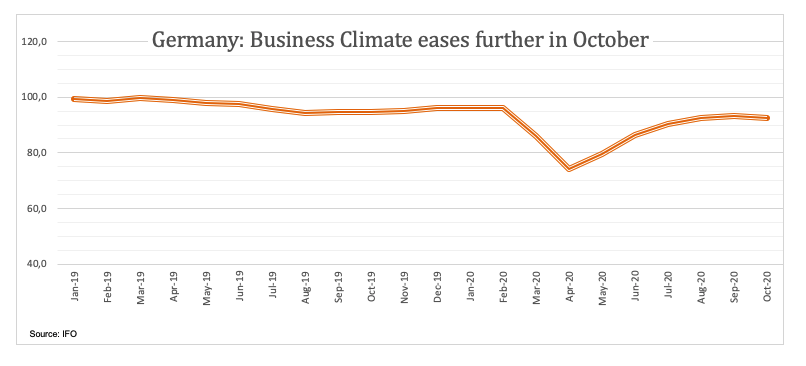

Also weighing on the single currency at the beginning of the week, the German Business Climate receded a tad to 92.7 in October, retreating from September’s multi-month peak above 93.0.

In the US docket, October’s New Home Sales are due later in the NA session followed by the Chicago Fed index.

What to look for around EUR

EUR/USD approaches the 1.1800 mark once again amidst renewed demand for the dollar. The outlook on EUR/USD remains positive, however, and bearish moves are deemed as corrective only. Further out, the positive bias in the euro remains underpinned by auspicious results from domestic fundamentals (despite momentum appears somewhat mitigated in several regions), the so far cautious stance from the ECB and the solid position of the EMU’s current account. In addition, the probable “blue wave” following the US elections is deemed as a negative driver for the greenback and carries the potential to lend extra legs to the pair in the longer run.

EUR/USD levels to watch

At the moment, the pair is losing 0.42% at 1.1807 and faces the next support at 1.1688 (monthly low Oct.15) followed by 1.1612 (monthly low Sep.25) and finally 1.1495 (monthly high Mar.9). On the other hand, a breakout of 1.1880 (monthly high Oct.21) would target 1.1917 (high Sep.10) en route to 1.1965 (monthly high Aug.18).