Back

23 Jun 2020

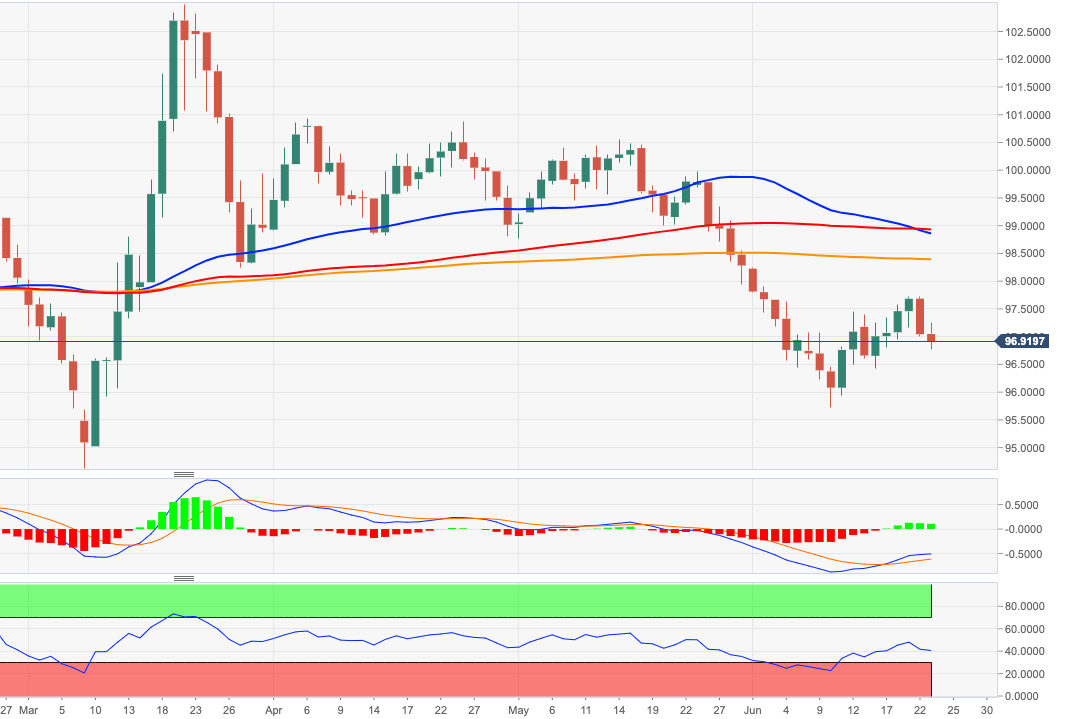

US Dollar Index Price Analysis: A drop to sub-96.00 is now in the pipeline

- DXY extends the leg lower to sub-97.00 levels on Tuesday.

- Further south is located the June’s low in the 95.70 zone.

The rebound in DXY from recent 3-month lows in the 95.70 region (June 10) appears to have met quite tough a barrier in the 97.90/85 band, area coincident with a Fibo retracement of the 2017-2018 drop (97.87).

If sellers remain in control, then there is the tangible probability of a retracement to the monthly lows in the 95.70 region.

Looking at the broader picture, the offered bias in the dollar is set to remain unchanged while below the 200-day SMA, today at 98.38.

DXY daily chart