EUR/USD Price Analysis: 1.1241 is the level to beat for bears

- EUR/USD jumped 0.4% on Tuesday, establishing 1.1241 as key support.

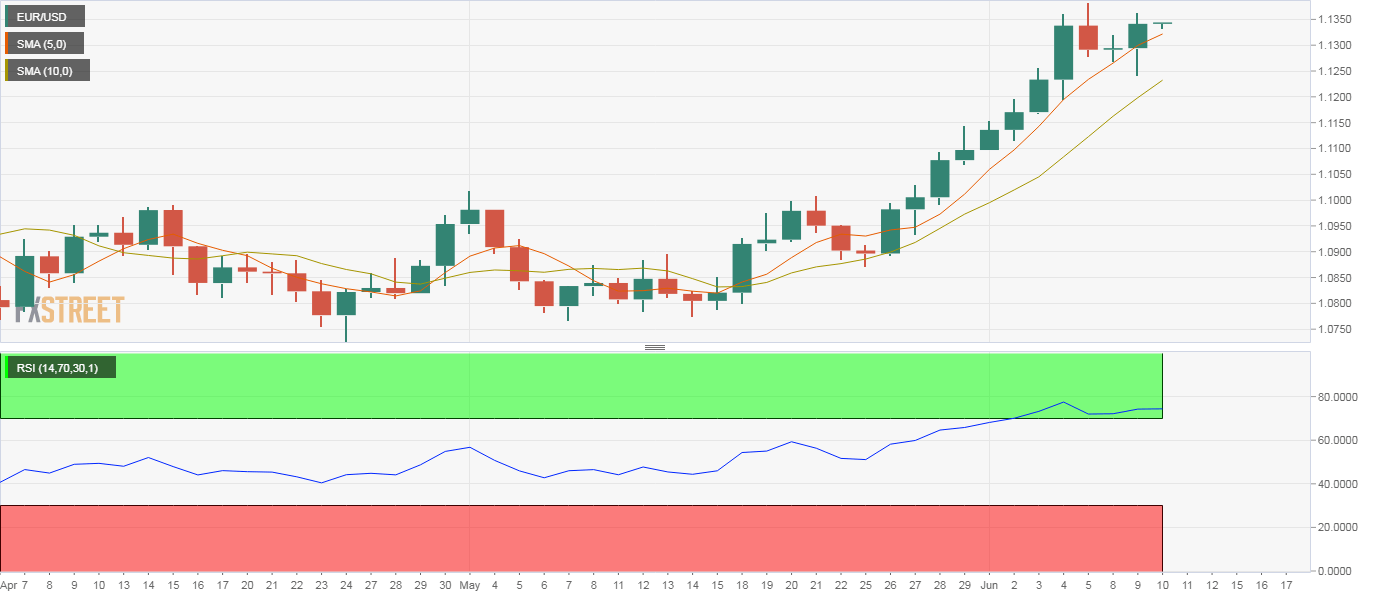

- The daily chart shows the path of least resistance is to the higher side.

EUR/USD is sidelined near 1.1340 in Asia, having found bids at 1.1241 and scored 0.40% gains on Tuesday.

The long-tail attached to Tuesday's candle is reflective of dip demand at 1.1241. Hence, the short-term bias would remain bullish as long as the pair is held above 1.1241.

A close below that level would validate the above-70 or overbought reading on the 14-day relative strength index and confirm a bullish-to-bearish trend change. That will likely yield a pullback to the 200-day simple moving average (SMA), currently at 1.1018.

At press time, the pair appears on track to re-test Friday's high of 1.1383. Moreover, Tuesday's candle closed well above Monday's Doji candle restoring the bullish bias. The 5- and 10-day moving averages are also trending north indicating a bullish setup.

Daily chart

Trend: Bullish

Technical levels