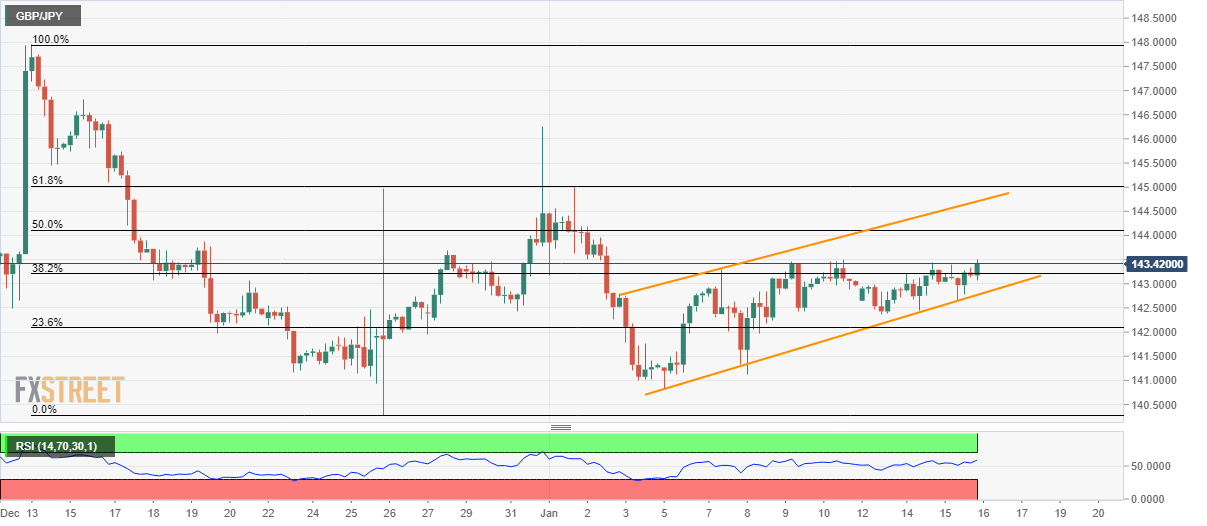

GBP/JPY Price Analysis: Short-term rising channel favors the bulls around 143.50

- GBP/JPY takes the bids near a one-week high.

- 50% Fibonacci retracement, eight-day-old ascending channel’s resistance will question the bulls.

- The sub-141.00 area could please the sellers on the downside break of the said channel.

GBP/JPY rises to 143.50, the highest since January 10, by the press time of early hours of Thursday’s Asian session. The pair follows an eight-day rising channel formation on the four-hour chart, which together with normal RSI conditions, favor its further recovery.

In doing so, 50% Fibonacci retracement of the quote’s declines from December 13 to 25, around 144.15, can become the immediate resistance ahead of the channel’s upper line around 144.70.

It should, however, be noted that the quote’s rise past-144.70 needs to be backed by the sustained break of 145.00 round-figure, also comprising 61.8% of Fibonacci retracement.

Meanwhile, sellers will look for entry below the aforementioned channel’s support-line, at 142.75 now.

The sustained downside below 142.75 may catch a breath near 23.6% Fibonacci retracement level of 142.00 ahead of targeting January 05 bottom, near 140.90 and the monthly trough surrounding 140.30.

GBP/JPY four hour chart

Trend: Bullish