GBP/USD Technical Analysis: Eyes on 1.3110/07 support confluence amid bearish MACD

- GBP/USD steps back from a multi-month high.

- Short-term support-confluence holds the key to the two-week-old rising trend line.

- Bulls look for entry beyond fresh highs.

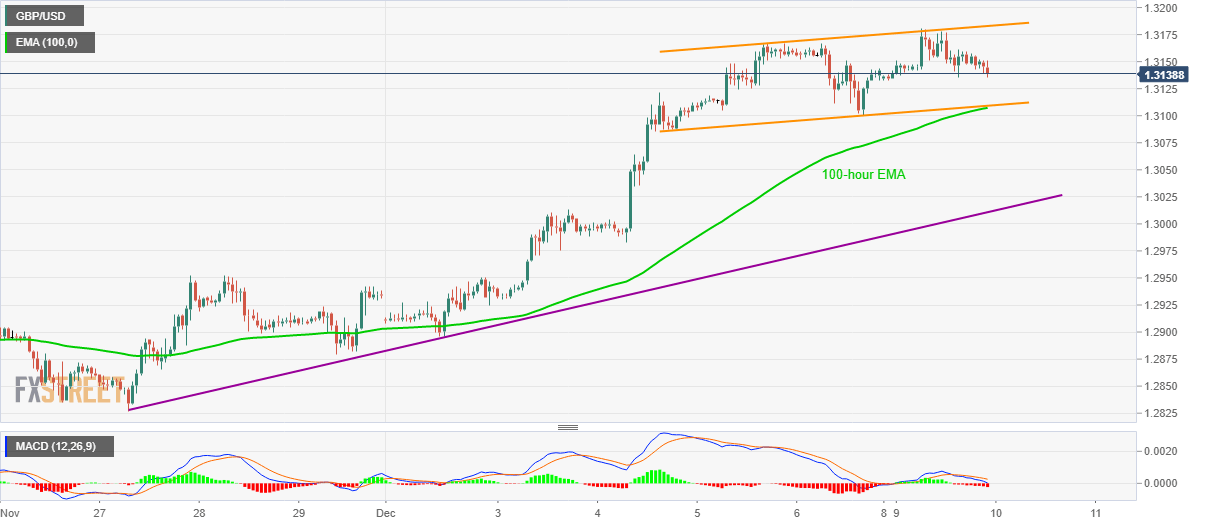

GBP/USD drops to 1.3140 amid the initial Asian trading session on Tuesday. The quote witnesses a pullback from an eight-month high. Also supporting the downside bias is the bearish signals from the 12-bar Moving Average Convergence and Divergence (MACD) indicator.

Sellers now await a clear break of a four day long ascending trend channel and 100-hour Exponential Moving Average (EMA) confluence around 1.3110/07. In doing so, a fortnight old rising support line near 1.3010 will be their target.

In a case prices slip below 1.3010, also fail to respect 1.3000 round-figure, late-November top near 1.2950 will be in the spotlight.

Alternatively, buyers will look for a sustained break of the recent high near 1.3180 to aim for 1.3200 and March 27 high surrounding 1.3270.

GBP/USD hourly chart

Trend: Pullback expected