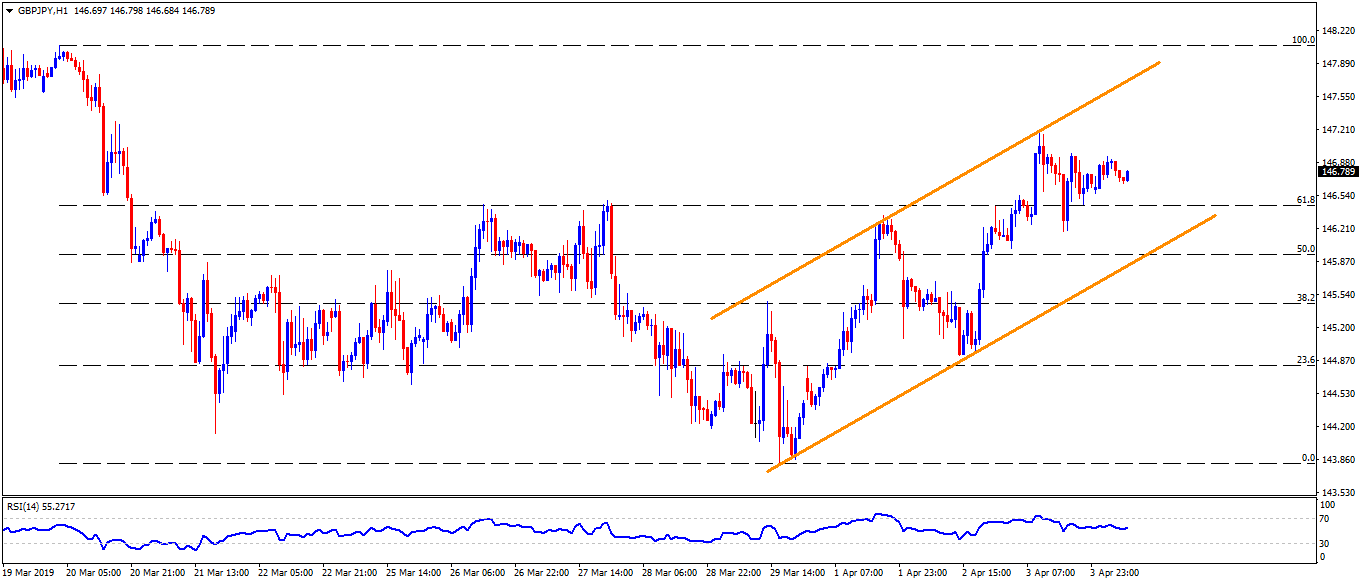

GBP/JPY Technical Analysis: Rising channel, sustained trading above 61.8% Fibo. favor return of 147.15

Despite failing to sustain 147.00 break-out, the GBP/JPY pair is on the bids around 146.75 ahead of the London open on Thursday.

The pair has been positive above 61.8% Fibonacci retracement of its March 20 to 29 declines whereas an upward sloping trend-channel further emphasize on the quote’s strength.

Hence, chances of the pair’s another attempt to cross 147.00 and even surpass recent high of 147.15 can’t be denied unless it stays above 61.8% Fibonacci retracement. However, 147.50/55 and the channel-resistance near 147.75 could challenge buyers then after.

In a case where prices rally past-147.75, recent high near 148.10 seems important as it holds the gate for the pair’s further rise towards 2019 high around 148.85.

Should the quote slips under 61.8% Fibonacci retracement level of 146.40, 50% Fibo near 145.90 and the channel support of 145.80 could gain market attention.

If at all the pair declines beneath 145.80 then 145.00, 144.50 and 143.80 could become sellers’ favorites.

GBP/JPY hourly chart

Trend: Mildly positive