NZD/USD sub-0.7200 as investors await Fed’s forecasts

- The Fed’s forecast for the pace of rate hikes in 2018 is the key focus.

- RBNZ is expected to stay on hold on Wednesday at 20.00 GMT.

The NZD/USD is trading at around 0.7192 down 0.70% as the focus remains on the FOMC on Wednesday at 18.00 GMT. BBH says: “There is nearly universal agreement that the FOMC will hikes rates at Powell’s first meeting. This is being taken for granted. The failure to raise interest rates would be significantly more disruptive than a hike at this juncture. Indeed, the focus is not so much on the rate hike, but the forward guidance provided by the FOMC statement and the Fed’s forecasts (dot plot).”

The Reserve Bank of New Zealand’s interest rate decision is on Wednesday at 20.00 GMT. However, the RBNZ is not expected to tighten monetary policy until the second half of 2019, according to ANZ. More information here.

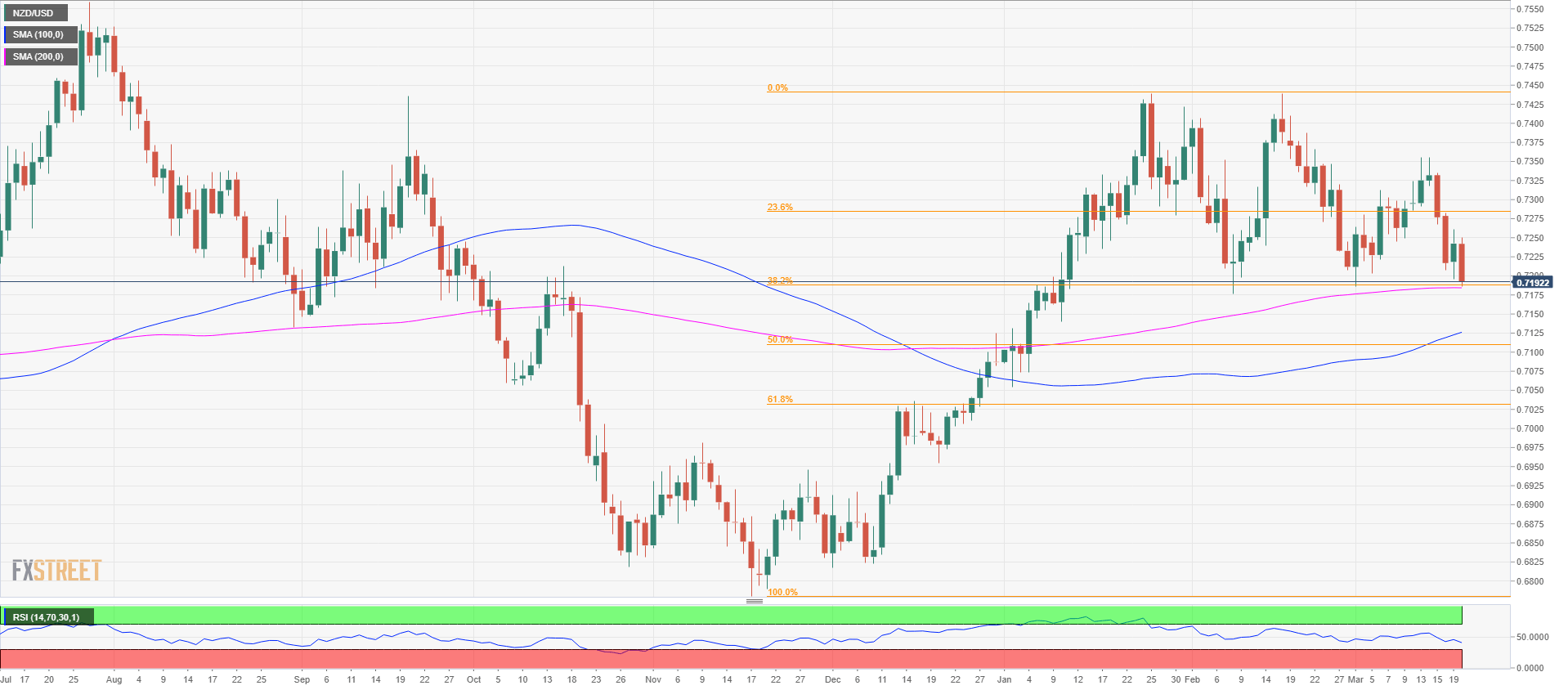

NZD/USD daily chart

The NZD/USD is testing its 200-period simple moving average and the 38.2% Fibonacci retracement from the November 2017-January 2018 bull run and trading below the 0.7200 level. A close below 1.7180 would likely open the gates to further losses with support seen close to the 0.7100 figure, the 38.2% Fibonacci retracement and then at the 0.7025 level, the 61.8% Fibonacci retracement. Resistance is seen at 0.7275, 23.6% Fibonacci retracement followed by the 0.7350 cyclical high.