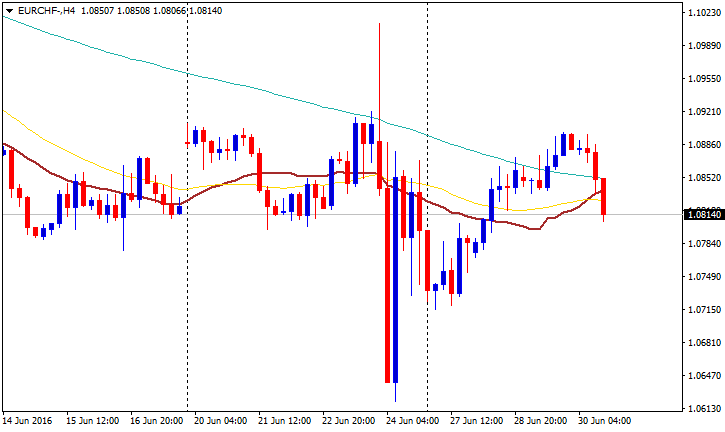

EUR/CHF ends 3-day recovery and drops toward 1.0800

EUR/CHF dropped sharply after the Brexit referendum results last week and since Monday it moved with a modest upside bias, until today that broke a short-term uptrend line and fell toward the 1.0800 region.

Under pressure

The pair managed to rise back above 1.0700 after the Brexit shock and yesterday it approached 1.0900 but the really found resistance and pulled back. A few hours ago it started to decline and accelerated the movement, erasing yesterday’s gains.

Recently it printed a fresh 2-day low at 1.0808 and it was trading around 1.0810/15, holding a bearish tone amid a stronger Swiss franc across the board. The Swissy was showing resilience in the market despite rising equity prices.

EUR/CHF technical levels

To the downside, support levels might lie at 1.0800 (psychological), 1.0765 (June 28 low) and 1.0715 (June 15 low). On the opposite direction, resistance could be seen at 1.0865 (20-hour moving average / Asian session low), 1.0899/1.0900 (June 29 & 30 high) and 1.0925 (June 13 high).