AUD/USD Price Analysis: Bears seek out the daily 61.8% Fibo

- AUD/USD bulls are in the process of a minor correction.

- The bias remains bearish towards the daily 61.8% Fibo area.

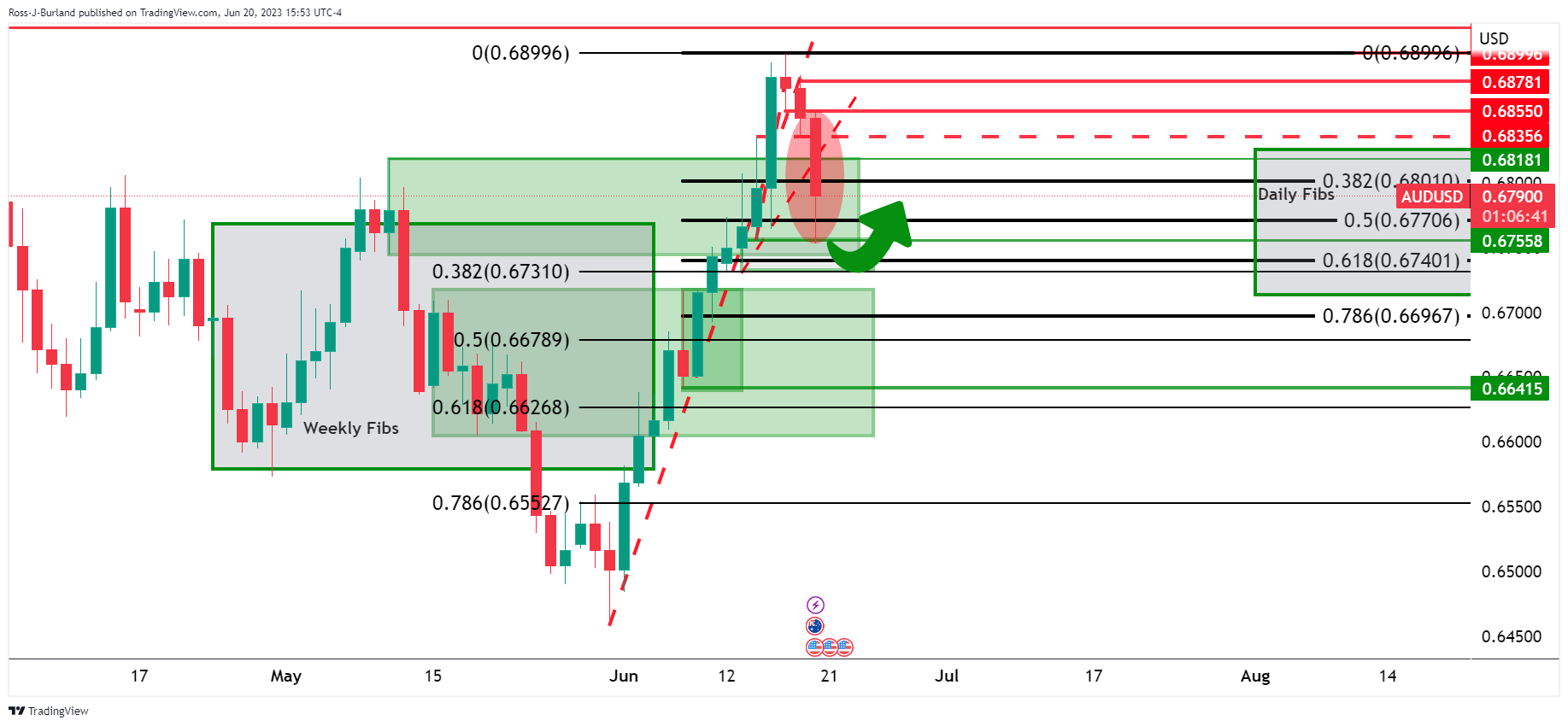

As per the prior analysis, AUD/USD Price Analysis: Bears grind towards key 4-hour support, the bears made their moves and squeeze longs out all the way to a 50% mean reversion of the prior daily bullish impulses range. The following is an analysis of the moves and offers possibilities for the forthcoming sessions and days.

AUD/USD prior analysis

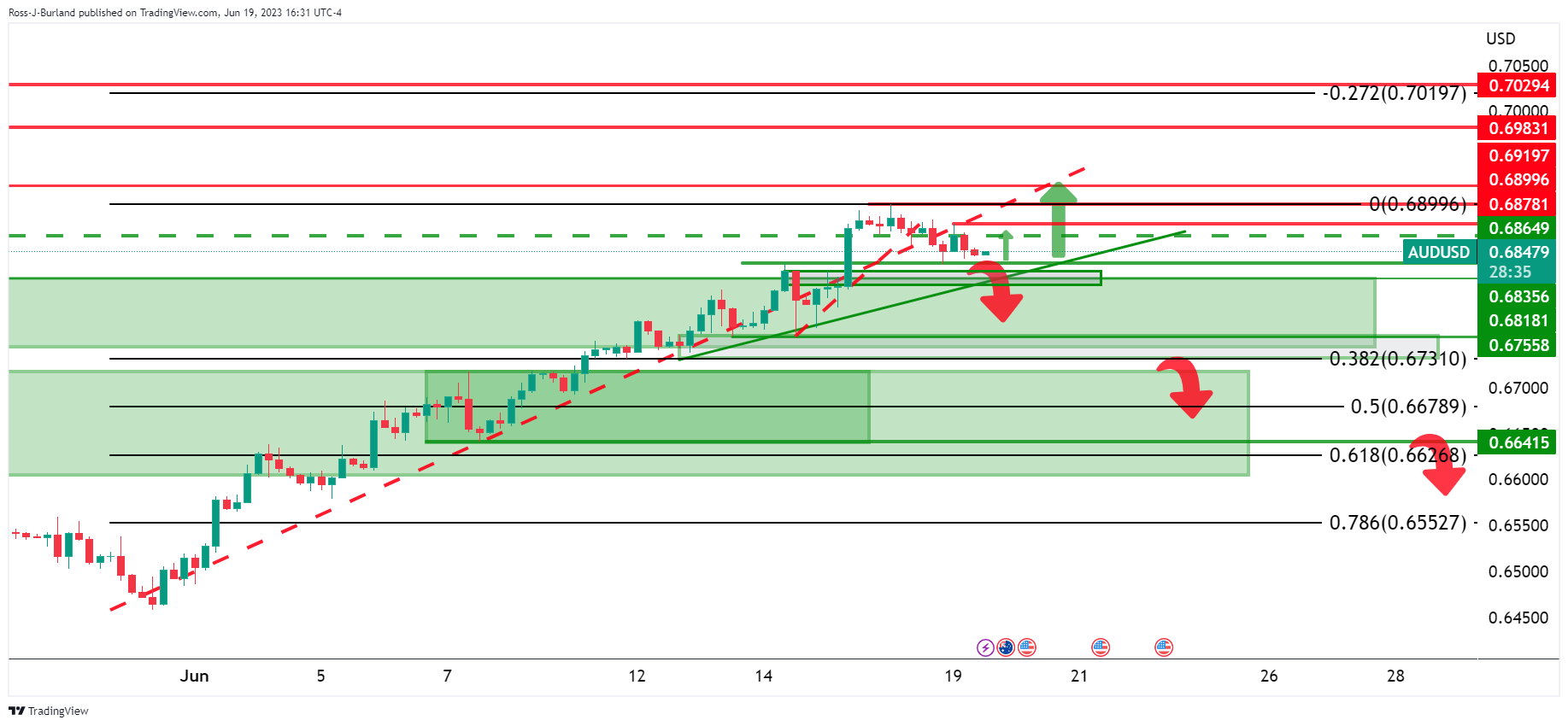

The pair were meeting resistance and the support structures were then put into focus.

Dropping down to the 4-hour chart, the bears were in anticipation of a move into both horizontal and trendline supports.

AUD/USD updates

The price has continued lower in a 50% mean reversion of the daily bullish impulse at 0.6770 reaching a low of 0.6753 and towards a weekly 38.2% Fibonacci level near 0.6730.

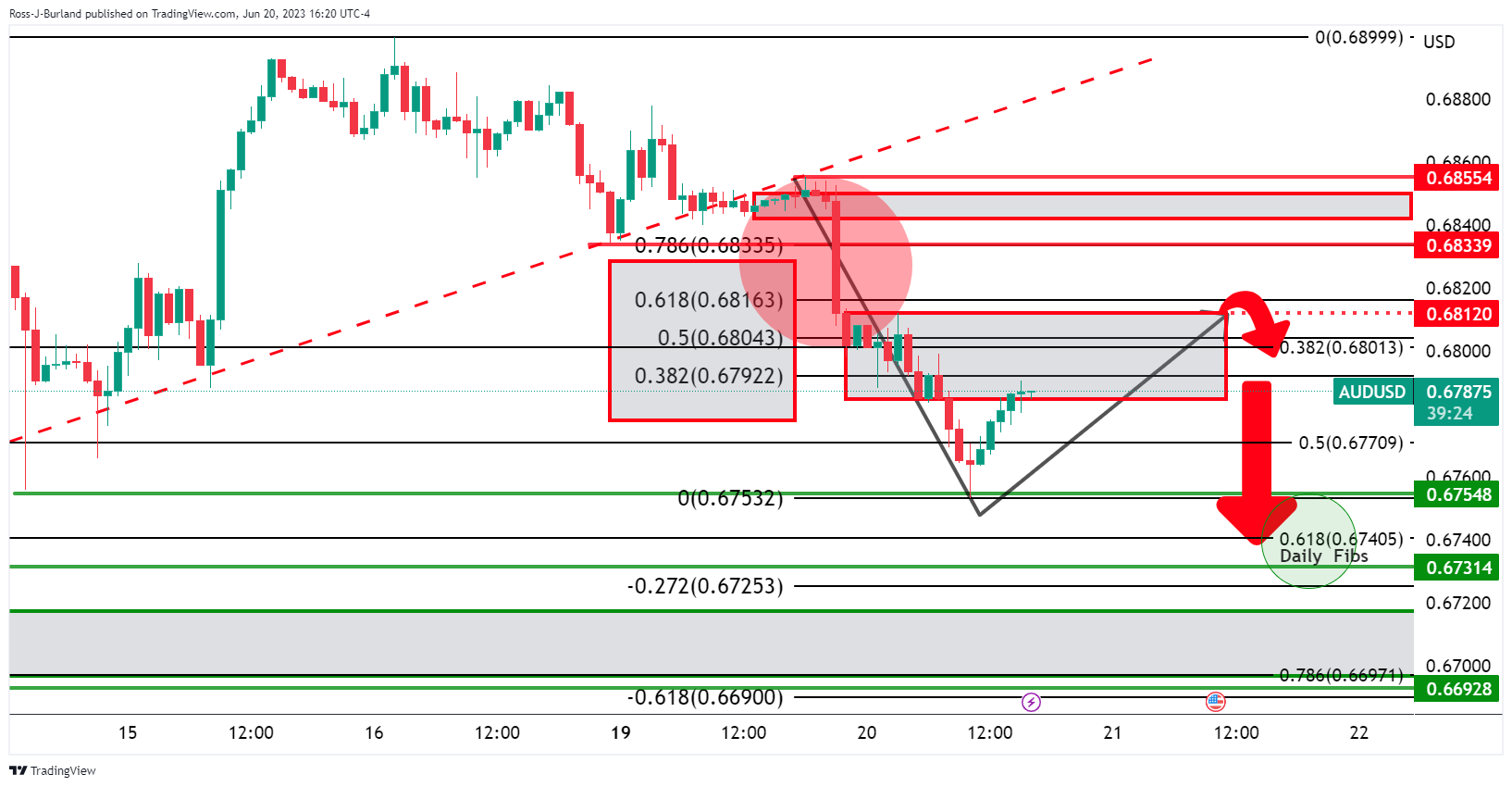

The 4-hour chart shows the price correction from the 0.6750 area. This leaves prospects of a move-in on the 38.2% Fibonacci a 50% mean reversion to test the 0.68 figure again and even a 61.8% ratio higher up prior to the next downside impulse getting underway.

Dropping down to the hourly chart, we see that the 50% mean reversion area guards an inefficiency between thereabouts, 0.6812 highs and 0.6850. The bottom of the inefficiency areas tend to act as a resistance.