EUR/USD Price Analysis: Bears firmly moving towards the daily trendline support

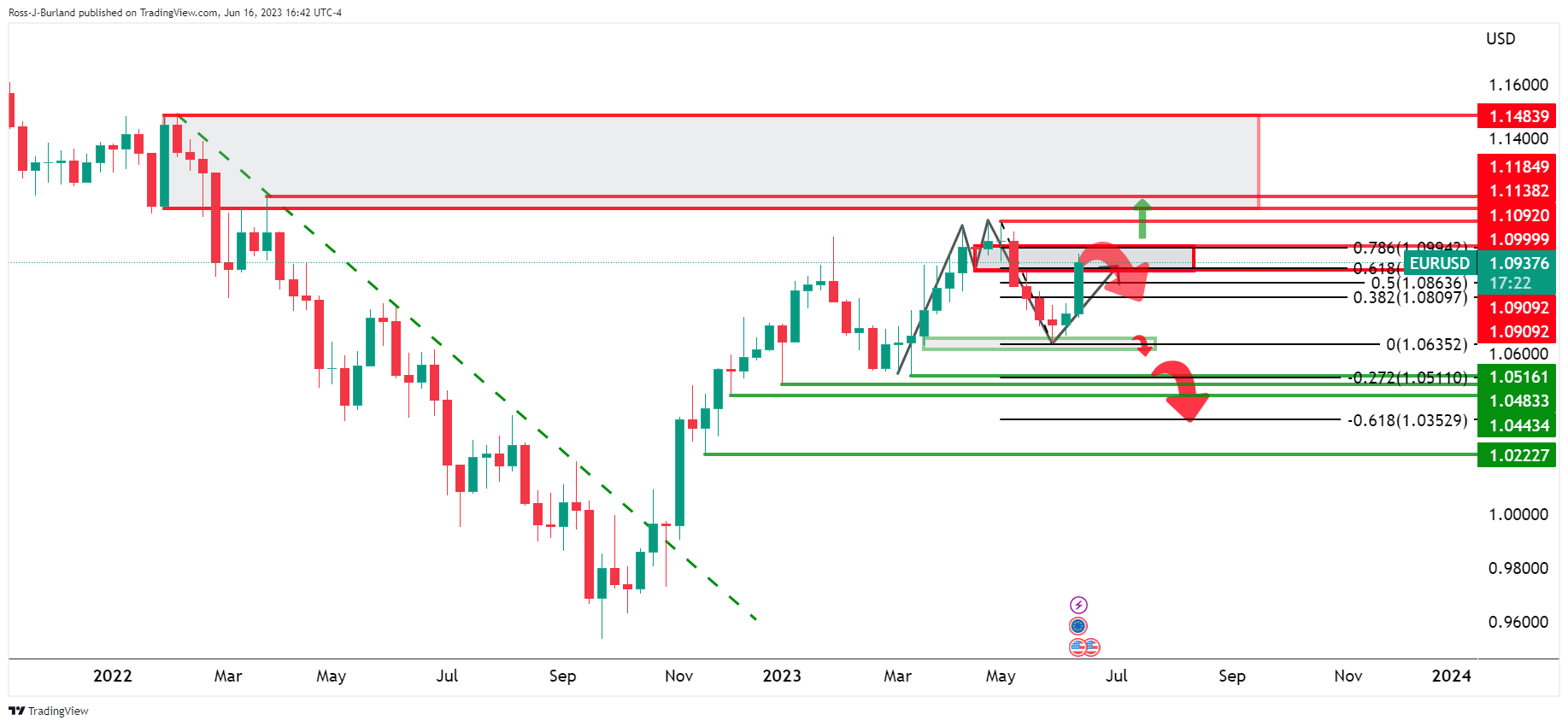

- EUR/USD bears are taking over and eye the trendline support.

- Bulls will need to stay committed above the daily 78.6% Fibo.

As per the prior analysis, EUR/USD Price Analysis: Bulls run into resistance, bears eye trendline support, EUR/USD is turning lower as the following will illustrate:

EUR/USD prior analysis

It was noted that the market had run into the weekly neckline of the M-formation.

On the daily chart, it was noted that we had possible stops above the swing highs that had been left intact, so far. Before a move higher into them, it was argued that a drive to the downside could be in order first. This brought the 38.2% Fibonacci of the bullish impulse on the daily chart into focus as well as the trendline support.

EUR/USD update

The price is moving lower toward the daily trendline support and from the neckline of the weekly M-formation.

From an hourly perspective, the price has broken structure, (BoS) and formed a fresh swing higher. therefore, we can anticipate another bearish impulse towards the trendline support in a 50% mean reversion or a 61.8% Fibonacci retracement of the prior hourly bullish impulse as follows:

A break of the trendline will dilute the bullish thesis but so long as the 78.6% Fibo holds on the daily chart, near 1.0780, a bullish case can still be argued.