Back

24 Apr 2023

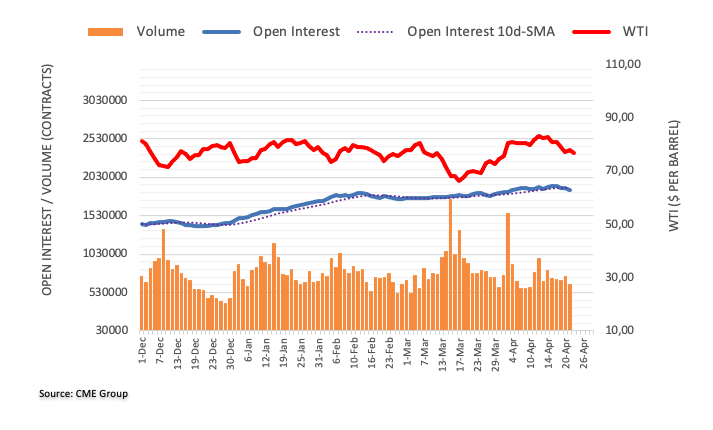

Crude Oil Futures: Extra losses in store near term

CME Group’s flash data for crude oil futures markets noted traders scaled back their open interest positions for the fourth session in a row on Friday, now by around 23.6K contracts. In the same line, volume resumed the decline and retreated by around 101.5K contracts.

WTI: Gap is nearly filled

The WTI charted a decent rebound on Friday amidst declining open interest and volume, which is indicative that further recovery is not favoured for the time being. The continuation of the corrective retracement in the commodity is expected to meet the next support at around $75.80.